Cameroon is fast becoming a battleground for international cement makers drawn by an abundance of major infrastructure projects and the end of a monopoly long held by Lafarge-Holcim Ltd.

Dangote Cement Plc and Morocco’s Douja Promotion Groupe Addoha SA have both announced expansion of production capacity in Cameroon this year, challenging Cimenteries du Cameroun, a unit of LafargeHolcim. Demand for cement is estimated to grow 8%/annum by 2020 from 3% now, said Trade Minister Luc-Magloire Mbarga Atangana.

The arrival in Cameroon of three foreign cement makers – the other is Medcem, a unit of Turkey’s Eren Holding – since the end of Cimenteries du Cameroun’s monopoly in 2012 has come alongside economic growth of 4.4% last year, compared with a sub-Saharan African average of 1.4%. Projects include the more than 300-kilometer dual-lane highway between Yaounde and Douala and a deep-water port in Kribi.

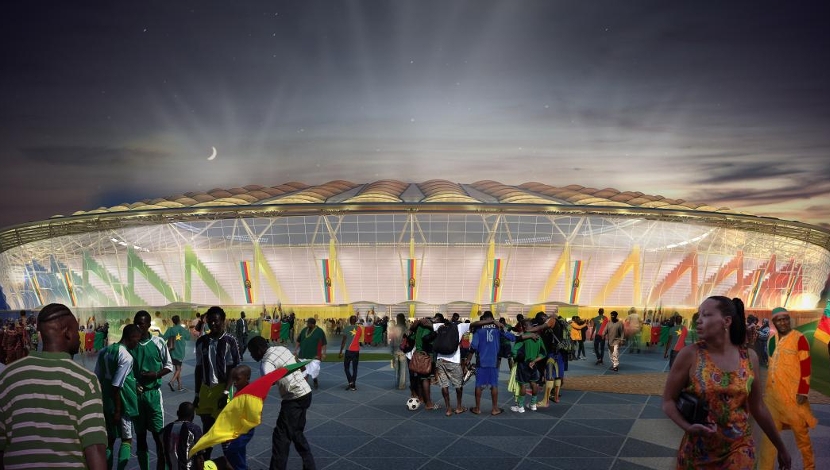

As the 2019 host of the Africa Cup of Nations soccer tournament, Cameroon’s government is also spending heavily on stadiums. There’s also a shortage of housing, with the urbanization rate in the country at about 3.5%.

Annual cement production stands at 4.2 mmt compared with 1.6 mmt three years ago. That’s before including planned expansion projects, the latest of which was announced by Addoha unit Ciment de l’Afrique (Cimaf) last week.

Cimaf said it plans to triple the production capacity of its Douala factory to 1.5 mmt by 2018 to become “a key player” in Cameroon and an exporter to neighboring countries including Gabon, the Central African Republic and Chad. Cimenteries du Cameroun last year started building a third plant in the country, at Nomayos.

Lagos-based Dangote Cement has started construction of a $150 million plant with annual capacity of 1.5 mmt in Yaounde.