According to Bloomberg, Dangote Cement Plc signalled it may ease the pace of adding new capacity amid foreign exchange constraints in its home market of Nigeria, as Africa’s largest producer of the building material reported a decline in first-half profit.

While the company remains committed to its ambitious growth plans, “we are taking a more measured approach to the roll-out of new capacity across Africa,” CEO Onne van der Weijde said in a statement on Thursday.

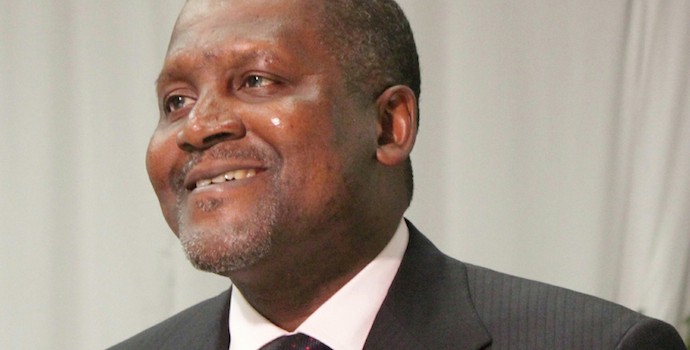

Dangote Cement, controlled by Aliko Dangote, has more than doubled production capacity since 2013 and said in April it may increase cement capacity by a further 77% by the end of 2019. Foreign-exchange constraints in Nigeria have prompted the company to reconsider the pace of its expansion and it now believes a five-year building program is more appropriate, it said.

Van der Weijde’s comment about a more measured approach “implies that management will be prioritising projects,” and “take time to properly articulate a long-term strategy in existing markets,” Jumai Mohammed, a Lagos-based analyst for Exotix Partners, said.

Profit for the six months through June declined to 106.3 billion naira ($342 million) from 123.1 billion naira a year earlier, the company said in a filing to the Nigeria Stock Exchange. Revenue increased 21% to 292 billion naira.

“We have achieved a commendable result, given the very challenging situation in our main market and general economic weakening across Africa,” the CEO said.

Earnings in the period were affected by lower selling prices, higher fuel costs and the lower efficiency of new plants still in start-up phases, the company said. Dangote posted a “weak but expected performance,” Mohammed said, as gas disruptions, the sharp depreciation of the naira and inflationary pressure weighed. Cement sales volumes in the period increased 60% bolstered by record volumes in Nigeria, where the company announced a price cut last September.

Inflation in NIgeria accelerated to 16.5% in June, the highest rate since October 2005, as the cost of food and gasoline surged due to foreign-exchange shortages caused by a 15-month currency peg. The naira was allowed to float from June 20, losing more than a third of its value against the US currency and weakening beyond 300 per dollar for the first time on July 22.

The devaluation of the currency will affect costs in the country and Dangote will seek to protect its profit margins, Van der Weijde said. Elsewhere on the continent, Dangote has increased market share in countries including Cameroon and Ethiopia and plans to begin operations at a new Republic of Congo plant in October, it said. The company remains confident of achieving “good growth” this year despite challenging economic conditions.