The New Development Bank (NDB) set up by the Brics group of emerging economies plans to lend $1.5-billion to South Africa for infrastructure projects over the next eighteen months.

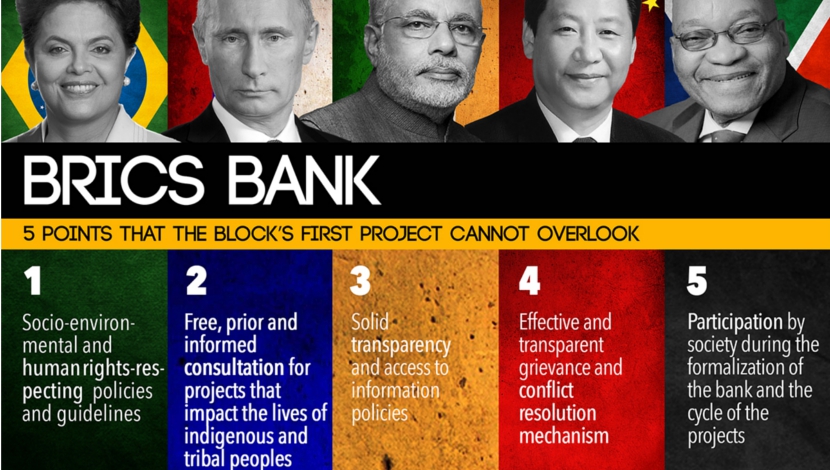

The BRICS – Brazil, Russia, India, China and South Africa – agreed to create the infrastructure-focussed lender in July 2014 as an alternative to the World Bank, launching it a year later.

The bank, headquartered in Shanghai, officially opened its African regional centre in Johannesburg on Thursday and will identify projects that it can fund.

“We have an appetite to do about $1.5-billion of lending to South Africa for the next 18 months and the task before the members of the Africa regional centre is to make sure that this pipeline is rectified into actual lending projects,” the bank’s president Kundapur Kamath said at the launch.

The NDB was created to address a massive infrastructure funding gap in the member countries, which account for almost half the world’s population and about one-fifth of global economic output.

It was founded with an initial authorised capital of $100-billion and started lending last year, funding seven projects worth $1.5-billion.

“Our target is to end 2018 with a total loan book of about $8-billion for approximately 35 projects,” Kamath said, referring to the loan book of the bank as a whole.

South African President Jacob Zuma said the regional office was expected to ease funding access hurdles for African countries, as the bank was working on expanding its membership to other countries outside the Brics.

“We expect that the bank through the Africa Regional Centre will contribute to accelerating infrastructure investment in energy, transport, water and other productive sectors,” Zuma said.